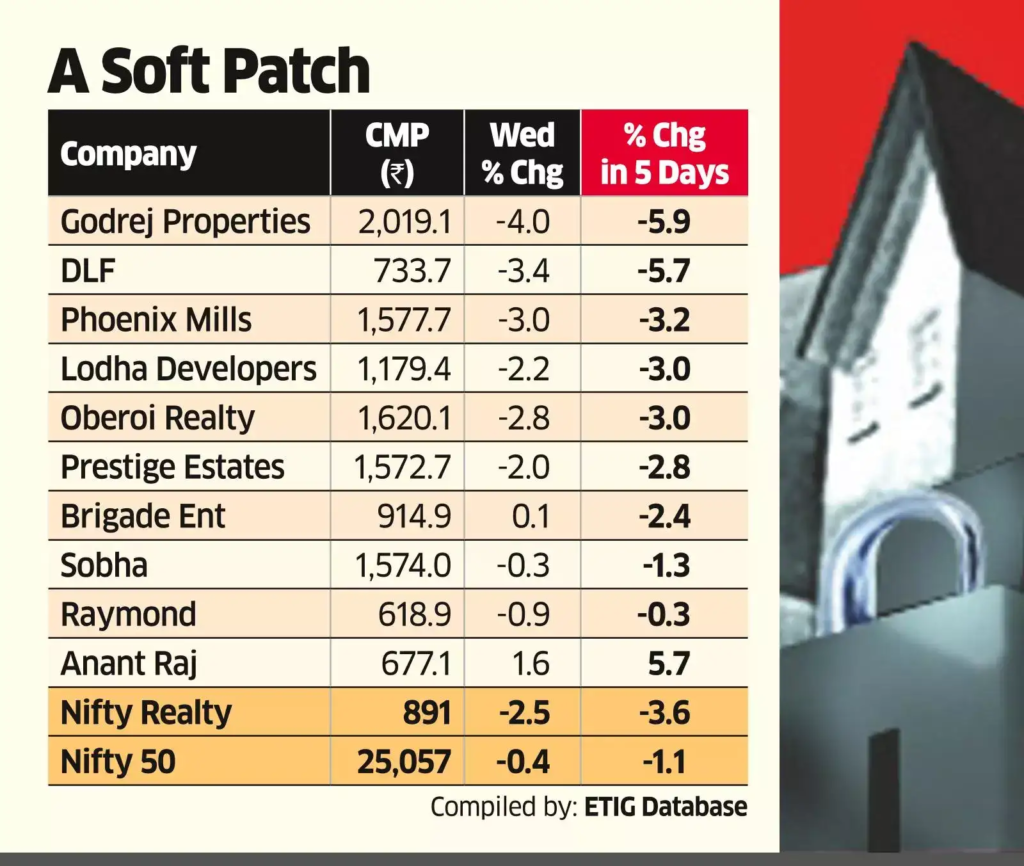

Indian equity markets witnessed continued pressure as real estate stocks declined for the seventh consecutive trading session, reflecting growing investor concerns over a potential slowdown triggered by IT sector layoffs, global economic uncertainty, and weak sentiment on Dalal Street.

According to market analysts, Dalal Street is increasingly factoring in the impact of reduced IT hiring, which could directly affect housing demand in major tech-driven cities such as Hyderabad, Bengaluru, and Pune.

Why Real Estate Stocks Are Falling

Experts tracking the Indian stock market, including benchmarks on the NSE and BSE, highlight several reasons behind the sustained decline:

- Rising concerns over IT layoffs in India and globally

- Fears of reduced housing demand from salaried tech professionals

- Higher interest rates impacting home loan EMIs

- Profit booking in real estate shares and infrastructure stocks

Mid-cap and small-cap real estate companies, which are more sensitive to demand fluctuations, have seen sharper corrections compared to large, diversified developers.

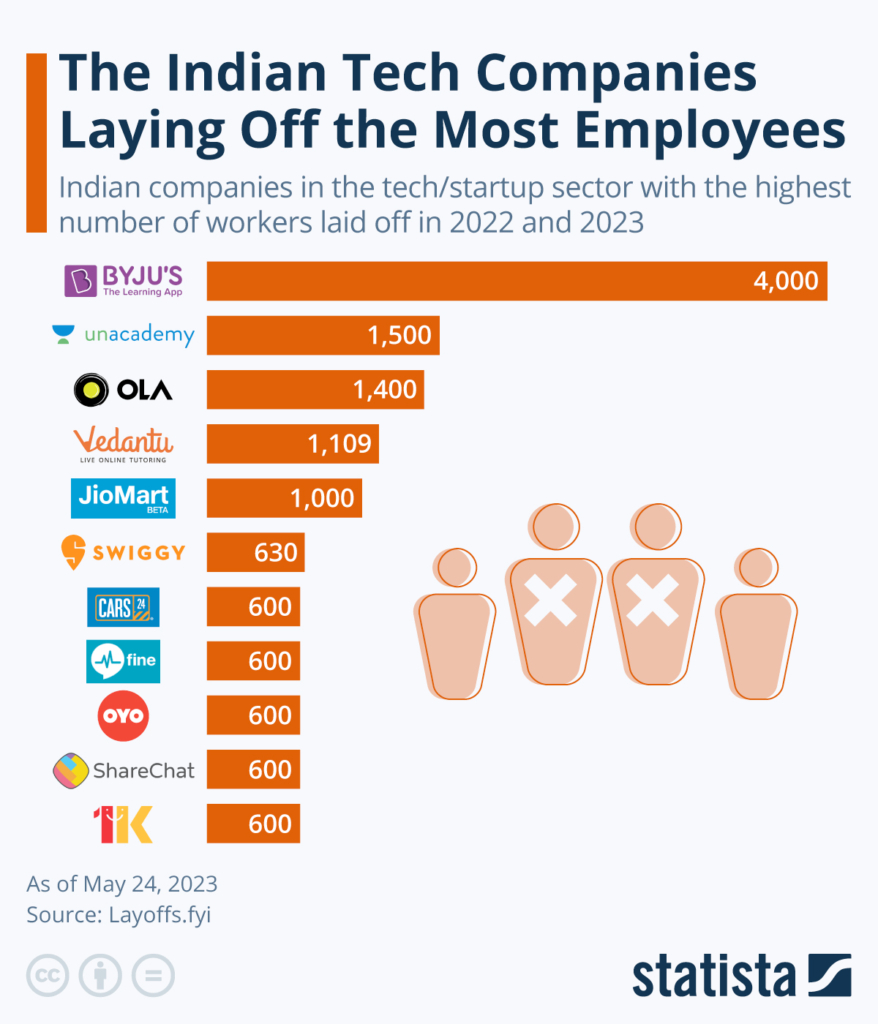

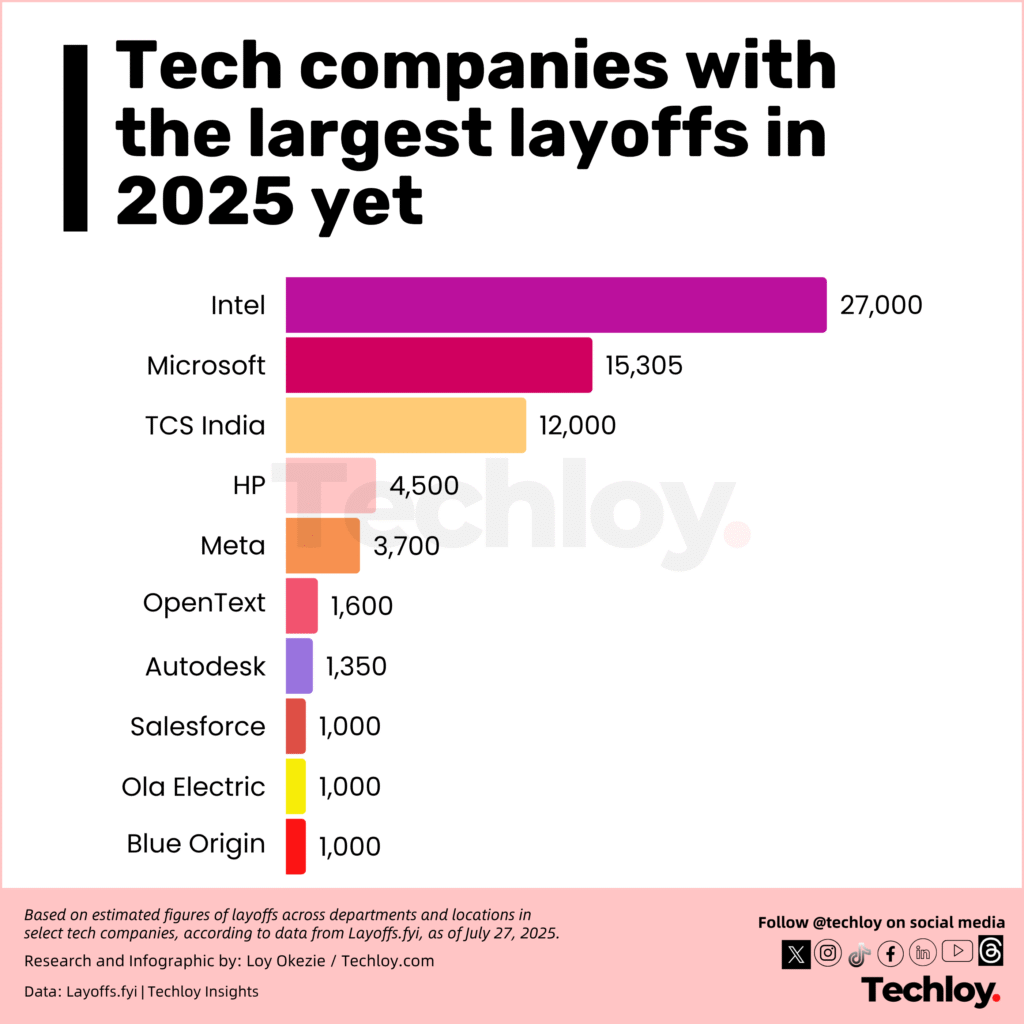

IT Layoffs and Their Impact on Property Markets

The IT sector plays a crucial role in driving urban housing demand, especially for:

- Residential apartments

- Gated communities

- Rental housing near IT corridors

Analysts believe that continued layoffs and hiring freezes could lead to:

- Slower absorption of residential inventory

- Increased caution among homebuyers

- Temporary pressure on property prices and rental yields

Cities heavily dependent on IT employment may witness short-term softness, though long-term fundamentals remain intact.

Analysts’ View: Short-Term Pain, Long-Term Opportunity

Market experts suggest that the current correction in real estate stocks may already be pricing in much of the negative news. While volatility may persist in the near term, long-term investors could see opportunities once:

- Interest rates stabilize

- IT hiring resumes

- Economic growth regains momentum

Several analysts maintain a neutral-to-positive outlook on fundamentally strong real estate companies with healthy balance sheets and diversified project portfolios.

What This Means for Homebuyers and Investors

While stock prices fluctuate, ground-level real estate demand—especially for end-use housing—remains relatively stable. For homebuyers:

- Market uncertainty can translate into better negotiation power

- Developers may offer attractive payment plans and discounts

- Long-term property investment in growth corridors remains viable

For investors, experts advise focusing on:

- Developers with strong cash flows

- Projects in prime, well-connected locations

- Cities with sustained infrastructure and job growth

HyderabadHome Market Insight

At HyderabadHome, we believe short-term stock market movements should not be confused with long-term real estate value. Despite market volatility, cities like Hyderabad continue to benefit from strong infrastructure development, metro expansion, and sustained residential demand.

If you are planning to buy property, invest in real estate, or explore upcoming residential projects, our experts can help you identify opportunities that align with your financial goals—even during uncertain market conditions.

Stay connected with HyderabadHome for the latest real estate news, stock market insights, property investment trends, and high-growth opportunities in Hyderabad.